Energy Renovation loan 2.0 : higher, faster, easier!

Around twenty Energy Houses spread throughout Flanders currently provide technical and financial support to assist households in improving their homes’ energy performance. In recent years, the Energy Houses granted approximately 5.000 “Flemish Energy Loans” per year to households, and assisted them in many different ways with realising their energy renovation plans. The reorganisation of the Flemish Energy Loan (2019) maintains the Energy Houses as a key actor in the Flemish energy renovation arena.

In order to further accelerate and deepen energy refurbishment and renovation, we are currently exploring alternative options for a new Energy Renovation loan (ER 2.0), in the context of the FALCO project, in close collaboration with several Energy Houses. The new personal loan’s key features are as follows:

- A higher maximum amount (up to 50.000 euro) can be borrowed compared to the current system (max. 15.000 euros), so as to allow households to combine several energy efficiency measures and achieve higher energy efficiency ambition levels;

- A longer maturity (up to 20 years) than other loans currently offered on the market. This enables borrowers to spread payments over a longer period and potentially to borrow higher amounts but paid back over a longer period, keeping monthly instalments more manageable.

- A modular approach to advisory & support services provided by the Energy Houses so as to align the latter’s assistance with the needs of more complex and integrated energy renovation investments.

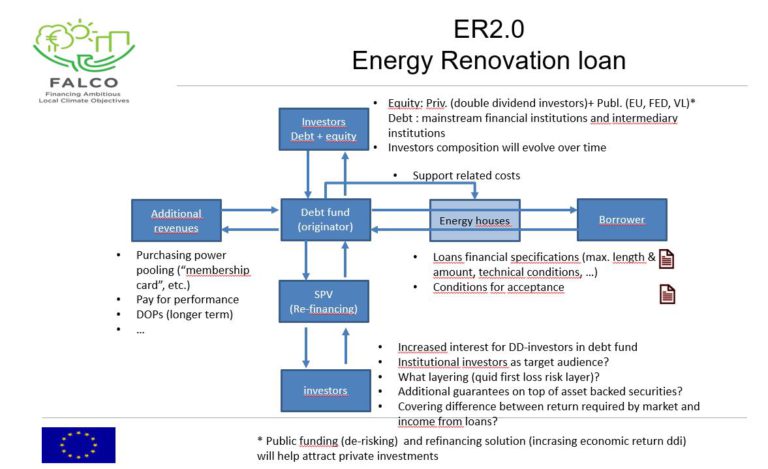

The financial solution currently under consideration is summarised in the picture below.

The building blocks of the solution are the following:

- A Debt Fund, structured as a revolving fund and offering ER2.0 loans (via the Energy Houses) to households for the energy renovation of their homes;

- A standardised ER2.0 loan offered via the Energy Houses;

- Additional revenues that will be used to cover (part of) the support and advisory services provided by the Energy Houses. A Membership Card System is being investigated here (see MCS webpage);

- A refinancing solution, e.g. through securitization, to accelerate the rotation of cashflow in the revolving fund and, hence, the granting of additional ER2.0 loans.

Discussions with potential investors, such as public institutions, commercial banks and private investors, are ongoing.

FALCO partners leading this breakthrough project: Antwerp, Tractebel, Suma Consulting